Accounting services

Ut sit amet semper arcu. Proin eget ex viverra lorem pretium. Morbi dapibus a tellus at euismod. Ut sit amet semper!

DetailsOur steadfast commitment to delivering exceptional customer service mirrors our dedication to nurturing long-term relationships with our members’ needs.

Join the SLC Trust family and let us take care of you!

Ut sit amet semper arcu. Proin eget ex viverra lorem pretium. Morbi dapibus a tellus at euismod. Ut sit amet semper!

DetailsUt sit amet semper arcu – dolor proin eget ex convallis eu viverra lorem pretium. Morbi dapibus a euismod lorem ipsum dolor.

DetailsUt sit amet semper arcu. Proin eget ex convallis eu viverra lorem pretium. Morbi dapibus a tellus.

DetailsUt sit amet arcu – dolor proin eget ex convallis eu viverra lorem pretium. Morbi dapibus at euismod lorem ipsum dolor.

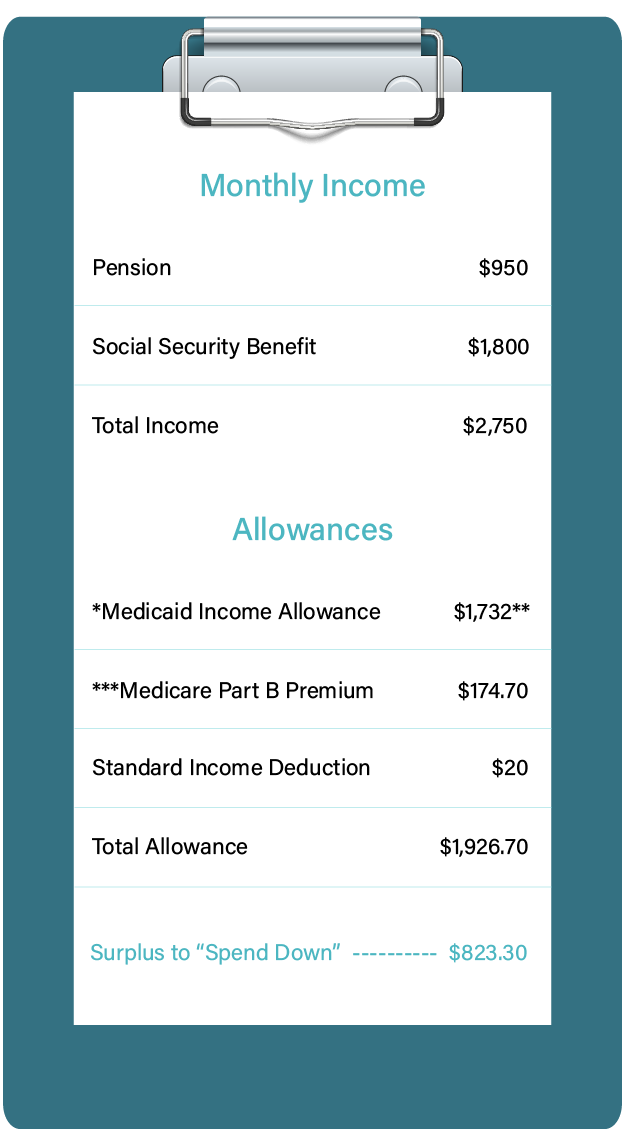

DetailsMedicaid income limit as of 2024. *This number is subject to change.** Medicare Part B is the component of Medicare that covers your preventative care and doctor visits. Outpatient surgery, laboratory work, and medical equipment also fall under the Part B umbrella. Average amount as of 01/2024

Leveraging a well-established approach, we aim to assist elderly and disabled Medicaid recipients in retaining surplus income to cover their nonmedical monthly expenses, such as rent, groceries, and utility bills, thus addressing the essential daily living costs

Once you have decided that the Pooled Income Trust is the best option for safeguarding your income, we will assist you in opening an account. The process is simple, and your dedicated Case Manager will provide guidance at every step.

If you meet the eligibility requirements, you will need to complete a series of forms to open your Trust account. These forms require basic information and are accompanied by simple instructions. Once we receive these forms along with your enrollment payment, your account will be established. The application process may take a few days, but we will notify you or your authorized representative once the application has been accepted or if we require any additional information.

Morbi dapibus a tellus - at aecenas sit amet tincidunt elit dolor senec euismod lorem ipsum dolor.

Dolor proin eget ex convallis eu viverra lorem pretium habitant morbi tristique senec.

Ut sit amet semper arcu – dolor proin eget ex convallis eu viverra lorem pretium.

“Thoughts are things! And powerful things at that, when mixed with definiteness of purpose, and burning desire, can be translated into riches.”